Request a Quote (Business) - Thank you

Power your

business with Geneco

Switch to a plan that’s made for your business’ needs.

Grab limited-time offer of up to S$500 bill rebate!

Grab limited-time offer of up to S$500 bill rebate!

Enjoy up to S$500 bill rebate when you sign up to our electricity plans from now to 30 September 2024.

How to enjoy deal?

Step 1

Choose and sign up to eligible plan

Step 2

Enjoy up to S$500 bill rebate

Promotion details

- Get up to S$500 bill rebate when you sign up to the eligible plans below. T&Cs apply.

- Promotion is only applicable to businesses with single premises and monthly electricity usage below 20,000kWh.

| Eligible Plan(s) | Plan Promotion | Promo Code |

|---|---|---|

| Biz Fixed 36 | S$500 bill rebate | 500BIZ36 |

| Biz Fixed 24 | S$300 bill rebate | 300BIZ24 |

| Biz Fixed 12 | S$150 bill rebate | 150BIZ12 |

Carbon Tax

Carbon Tax Impact

on Electricity Customers

A. Singapore Carbon Tax & Power Sector Contributions to Climate Change

In September 2016, Singapore ratified the Paris Agreement, an international treaty to reduce greenhouse gas emissions. Under the Agreement, Singapore pledged to reduce its emissions intensity by 36% from 2005 levels by 2030 and stabilise emissions with an aim of peaking around 2030.

To fulfil the country’s climate change obligations under the Paris Agreement, Singapore announced the imposition of a S$5 carbon tax for every tonne of greenhouse emissions on direct emitters (which include power generating companies) from 1 Jan 2019 onwards till 20231. The aim of the carbon tax is to encourage direct emitters and downstream consumers to be more energy efficient and reduce carbon dioxide emissions.

The power sector has contributed significantly to Singapore’s climate goals by achieving carbon emission reductions of 15% between 2010 and 20152. This is achieved through substantial investments in more efficient power plant units over the years. Consequently, the nation’s electricity (> 95%) is currently being produced by natural gas-fired3 combined cycle gas turbines and co-generation plants. The remaining 5% is produced by solar and waste co-generation facilities. There is very limited scope for power generators to reduce carbon emission levels or switch to other fuels to avoid/reduce carbon tax based on current stock of power plants in the Singapore power system.

Singapore’s land scarcity and the unsuitability of numerous renewable energy technologies (such as wind and tidal) also means power generators have limited scope to invest in zero-emission renewable energy. Therefore, end-consumers will also have to play their part. The carbon tax will act as an incentive for end-consumers to improve energy efficiency and reduce overall energy consumption.

To cushion the carbon tax impact on end-consumers, the Singapore government announced financial assistance schemes such as the Energy Efficiency Fund (E2F) and the Resource Efficiency Grant for Energy (REG(E)) for companies and U-Save rebates for households. Taking all the above into consideration, a carbon tax will be applicable to all end-consumers from 1 Jan 2019 onwards. This would mean a carbon tax charge will apply for every unit of electricity (kWh/MWh) that electricity retailers sell to consumers from 1 Jan 2019 onwards.

B. Our Collective Role in Fulfilling Singapore’s Climate Change Targets

Since 2002, the energy efficiency of the power industry has improved substantially by moving away from emission-heavy fuel oil-fired steam plants and making substantial investments in cleaner and more efficient gas-fired power generation assets. This move has led to an almost 67%4 increase in efficiency, reducing the amount of CO2 emitted per unit of electricity produced (or Grid Emission Factor5) by an estimated 20%6 from 2005 to 2016.

The power industry will continue to optimise the performance of its existing power plants and make investments in more efficient power plant technologies. For a start, it is expected to tap into available energy efficiency funds offered by the Government to improve the efficiency of power plants in future years.

At the same time, end-consumers can play their part by adopting energy conservation measures (e.g. reducing their electricity consumption) to lower their carbon tax charges. Power generating companies will also work with the government to educate consumers on energy conservation initiatives.

C. Carbon Tax Charge

The carbon tax charge, which takes effect for every unit of electricity (in kWh) consumed from 1 Jan 2019, is calculated using the reference formula:

Carbon Tax Charge

= Electricity consumed* (in kWh) x GEF-OM^ x Carbon Tax Rate**

*based on loss adjusted consumption.

**S$5/tCO2e carbon tax rate as announced by the Singapore government which is valid till 2023. tCO2e = tonnes of carbon dioxide equivalent.

^GEF-OM is the Grid Emission Factor-Average Operating Margin published by the Energy Market Authority (EMA). It represents the power system-wide CO2 emissions per unit of net electricity generated into the grid. This is the generation-weighted average CO2 emission per unit net electricity generation of all generating power plants serving the electricity grid/pool and which is sold to (i.e. consumed by) end-consumers.

Net electricity refers to the units of electricity sold to the grid/pool (i.e. units of electricity generated by power generators less off losses at the power generator and the power grid).

The carbon tax charge will appear as a separate line item in customer bills by default. This is to allow customers to be more cognisant of the carbon tax they incur each month. It also allows customers with existing or future carbon accounting and/or carbon reporting requirements in their organisations to have easy access to the data.

For customers who prefer the convenience of having an all-in rate, the carbon tax charge may also take the form of a bundled rate (i.e. carbon tax charge is incorporated into the electricity price). Regardless of the form the carbon tax charge will be represented in customer bills (i.e. single line item or all-in rate), it will be computed based on the formula above.

Example: For a company that consumes 50,000kWh of electricity in the month of Jan 2019, the carbon tax charge for 50,000 kWh of electricity consumed in the month of Jan 2019 works out to:

Carbon Tax Charge

= Electricity consumed (in kWh) x GEF-OM x Carbon Tax Rate

= 50,000 kWh x 0.4192 tCO2e/MWh7 x S$5/tCO2e

= 50 MWh8 x 0.4192 tCO2e/MWh x S$5/tCO2e

= S$104.8 (works out to S$2.1/MWh or S$0.0021/kWh)

FAQ

1. Why do consumers need to pay for carbon tax charges?

The Singapore government announced the imposition of the carbon tax which will come into effect for carbon dioxide emissions from 1 Jan 2019 to encourage both emitters and end-consumers to improve energy efficiency so that overall carbon emissions may be reduced. To help cushion the impact of carbon tax, the government also announced financial assistance schemes such as the Energy Efficiency Fund (E2F) and the Resource Efficiency Grant for Energy (REG(E)) for companies and U-Save rebates for households.

All our electricity contracts/agreements with consumers provide that new or additional third party charges and/or costs associated with the supply of electricity shall be borne by consumers. Carbon tax falls into the scope of such new or additional charges/costs.

2. I am also a direct emitter. Do I still have to pay the carbon tax from Geneco? Isn’t that a double count?

Direct emitters will have to pay carbon tax for the energy they purchase from Geneco. There is no double counting as direct emitters pay carbon tax for carbon dioxide emissions arising from their facility’s activities, which is independent from the carbon tax due to energy they purchase from Geneco.

3. What is the amount of carbon dioxide or greenhouse gases emitted by your generation company and how does this relate to the carbon tax paid by consumers?

The amount of carbon dioxide emitted by the generation company is based on the amount of energy produced by the generation company’s power plants.

The amount of carbon tax paid by the consumer is based on the amount of loss adjusted energy sold to the consumer. For electricity, the losses at the power generator and the power grid account for the difference between the amount of energy generated and the amount of loss adjusted energy sold to the consumer.

4. How can I be sure that I am charged fairly for carbon tax?

The carbon tax charge is based on the reference formula below.

Carbon Tax Charge

= Electricity consumed (in kWh) x GEF-OM x Carbon Tax Rate

Electricity consumed is based on loss adjusted consumption.

GEF-OM is a published figure by the EMA (Energy Market Authority).

Carbon Tax Rate is S$5 tCO2e/MWh as announced by the Singapore government.

For further details, please refer to guidance item C on ‘Carbon Tax Charge’.

5. Will the carbon tax charge be constant or vary through the contract period?

Further to FAQ4 above, the carbon tax charge depends on i) the energy consumed, ii) the GEF-OM (which changes on a yearly basis) and iii) the carbon tax rate which is valid till 2023.

6. What if I do not agree to the carbon tax charges? Is it a breach of contract?

All our electricity contracts/agreements with consumers provide that new or additional third party charges and/or costs associated with the supply of electricity shall be borne by consumers. Carbon tax falls into the scope of such new or additional charges/costs. We have set out the computation of the carbon tax charge above.

7. Currently, I am using some renewables for my supply, why do I have to pay carbon tax?

Consumers do not need to pay carbon tax for the energy they consume from renewable energy sources (e.g. solar PV). However, consumers will need to pay for energy they consume from non-renewable energy sources (e.g. electricity from power generators).

8. I am interested to buy carbon credits, can that help to reduce the carbon tax charges that I am paying to Geneco?

The carbon tax framework in Singapore currently does not allow the use of carbon credits (from renewable energy projects) to offset a company’s carbon tax liabilities.

However, there may be possible future plans for the Singapore government to offset carbon tax with carbon credits.

9. Why is GST applied on the Carbon Tax Charge?

Carbon Tax and Goods and Services Tax (“GST”) serve different purposes.

The GST is a tax levied on the consumption of goods and services. It is calculated based on the final price of goods or services, inclusive of any other taxes and duties. Carbon tax is part of the final price of electricity that the GST is levied on. This is similar to the water conservation tax, which is part of the final price of water that the GST is levied on.

1 Singapore Budget Speech 2018

2 The amount of CO2 emitted per unit of electricity produced reduced by 15% between 2010 and 2015, Pg 27 of Singapore Climate Action Plan 2017

3 Natural gas is the least carbon-intensive fossil fuel on Earth

4 Switch from fuel oil-fired steam plants (~30% efficiency) to higher efficiency gas-fired plants (~50% efficiency)

5 refers to Grid Emission Factor-Average Operating Margin. Further explanation on item C above on ‘Carbon Tax Charge’ of this document

6 Source : Information on Grid Emission Factors (Operating Margin), NEA

7 Singapore Energy Statistics 2018

8 1000 kWh = 1 MWh

FAQ - Transmission Loss Factors (Business)

About Transmission Loss Factors

The Transmission Loss Factor (TLF) is calculated by the Market Support Services Licensee, SP Services Ltd in accordance with the methodology approved by the regulator, the Energy Market Authority of Singapore1.

In practice, it varies depending on the voltage level at which a consumer takes its electricity supply. The higher the voltage level, the lower the TLF. The metered quantity of electricity generated by generating units is more than the metered quantity of electricity consumed due to transmission losses (energy loss as heat as electric current passes through the transmission system (comprising the transmission network and distribution network)) as well as unaccounted for energy2.

The TLF is used to allocate the difference to consumers based on their deemed contribution to this difference (mainly transmission losses for Singapore, unaccounted for energy can be greater than transmission losses in a few other countries due to rampant electricity theft). The lower the voltage level of electricity consumption, the more transmission losses are incurred delivering electricity from where it is generated to where it is consumed. This explains why TLF is higher for electricity consumption at lower voltage levels.

The table below (Source: SP Group) shows the TLFs by the Market Support Services Licensee, SP Services Ltd, in accordance with the methodology approved by the Energy Market Authority of Singapore.

| Load | Transmission Loss Factors effective

01 April 2024 |

Transmission Loss Factors effective

01 April 2023 |

Transmission Loss Factors effective

01 April 2022 |

|---|---|---|---|

| 230kV/400kV | 1.0 | 1.0 | 1.0 |

| 66kV | 1.0 | 1.0 | 1.0 |

| 22kV | 1.003374 | 1.003404 | 1.004373 |

| 6.6kV | 1.008527 | 1.008472 | 1.019872 |

| 230V | 1.01295 | 1.016957 | 1.036482 |

| Voltage Level | Transmission Loss Factors effective

01 April 2024 |

|---|---|

| 230kV/400kV | 1.0 |

| 66kV | 1.0 |

| 22kV | 1.003374 |

| 6.6kV | 1.008527 |

| 230V | 1.036482 |

| Voltage Level | Transmission Loss Factors effective

01 April 2023 |

|---|---|

| 230kV/400kV | 1.0 |

| 66kV | 1.0 |

| 22kV | 1.003404 |

| 6.6kV | 1.008472 |

| 230V | 1.016957 |

| Voltage Level | Transmission Loss Factors effective

01 April 2022 |

|---|---|

| 230kV/400kV | 1.0 |

| 66kV | 1.0 |

| 22kV | 1.004373 |

| 6.6kV | 1.019872 |

| 230V | 1.036482 |

How Changes in TLF Impacts a Geneco Customer

For Geneco’s electricity customers, a change in the TLF which in practice applies from 1 April of every year may or may not impact their electricity bills. It depends on the contract terms which may be loss-adjusted or metered. Loss-adjusted means that the metered electricity quantity is multiplied by the relevant TLF to obtain the deemed electricity quantity consumed. Therefore loss-adjusted customers are affected by changes in the TLF.

For metered customers, the metered electricity quantity is not multiplied by the relevant TLF to obtain the deemed electricity quantity consumed. Therefore, metered customers are not affected by the changes in the TLF.

As metered customers do not have their metered electricity consumption scaled up by the TLF, they have an implicit discount vis-à-vis loss-adjusted customers paying the same electricity price. Pricing and discounts are therefore naturally different for loss-adjusted versus metered customers.

1 See Market Support Services Code here for more details.

2 A catch-all to classify the residual difference not accounted for by transmission losses. It includes under-metering of electricity consumption which can be due to various reasons and accounts for the fact that the estimation of transmission losses is not an exact science.

FAQ - Use of System Charge (Business)

Use of System Charge

The Use-of-System charges, which is payable to SP Group, is to recover the cost of transporting electricity through the national power grid. Note that the charges differ according to the voltage at which a consumer receives the electricity supply.

Effective 1 April 2024 to 31 March 2025

| Contracted Capacity Charge ($/kW/month) | Peak Period Charge (¢/kWh) | Off-Peak Period Charge (¢/kWh) | Reactive Power Charge (¢/kVArh) | Uncontracted Capacity Charge 7 ($/kW/month) | Uncontracted Capacity Charge10 ($/kW/month) | |||

|---|---|---|---|---|---|---|---|---|

| CCS8 | ECCS9 | |||||||

| Tier 1 | Tier 2 | |||||||

| Ultra High Tension 1 | 9.31 | 0.06 | 0.02 | 0.44 | 13.97 | 46.55 | 46.55 | 111.72 |

| Extra High Tension 2 | 12.90 | 0.08 | 0.03 | 0.48 | 19.35 | 64.50 | 64.50 | 154.80 |

| High Tension - Large 3 | 16.37 | 0.74 | 0.08 | 0.59 | 24.56 | 81.85 | 81.85 | 196.44 |

| High Tension - Small 4 | 16.37 | 0.96 | 0.09 | 0.59 | 24.56 | 81.85 | 81.85 | 196.44 |

| Low Tension - Large 5 | - | 6.46 | 5.14 | - | - | - | - | - |

| Low Tension - Small 6 | - | 6.46 | - | - | - | - | - | |

| Ultra High Tension 1 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Contracted Capacity Charge ($/kW/month) | 9.31 | ||||||||

| Peak Period Charge (¢/kWh) | 0.06 | ||||||||

| Off-Peak Period Charge (¢/kWh) | 0.02 | ||||||||

| Reactive Power Charge (¢/kVArh) | 0.44 | ||||||||

| Uncontracted Capacity Charge 7 ($/kW/month) | 13.97 | ||||||||

| Uncontracted Capacity Charge 10 ($/kW/month) |

|

||||||||

| Extra High Tension 2 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Contracted Capacity Charge ($/kW/month) | 12.90 | ||||||||

| Peak Period Charge (¢/kWh) | 0.08 | ||||||||

| Off-Peak Period Charge (¢/kWh) | 0.03 | ||||||||

| Reactive Power Charge (¢/kVArh) | 0.48 | ||||||||

| Uncontracted Capacity Charge 7 ($/kW/month) | 19.35 | ||||||||

| Uncontracted Capacity Charge 10 ($/kW/month) |

|

||||||||

| High Tension - Large 3 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Contracted Capacity Charge ($/kW/month) | 16.37 | ||||||||

| Peak Period Charge (¢/kWh) | 0.74 | ||||||||

| Off-Peak Period Charge (¢/kWh) | 0.08 | ||||||||

| Reactive Power Charge (¢/kVArh) | 0.59 | ||||||||

| Uncontracted Capacity Charge 7 ($/kW/month) | 24.56 | ||||||||

| Uncontracted Capacity Charge 10 ($/kW/month) |

|

||||||||

| High Tension - Small 4 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Contracted Capacity Charge ($/kW/month) | 16.37 | ||||||||

| Peak Period Charge (¢/kWh) | 0.96 | ||||||||

| Off-Peak Period Charge (¢/kWh) | 0.09 | ||||||||

| Reactive Power Charge (¢/kVArh) | 0.59 | ||||||||

| Uncontracted Capacity Charge 7 ($/kW/month) | 24.56 | ||||||||

| Uncontracted Capacity Charge 10 ($/kW/month) |

|

||||||||

| Low Tension - Large 5 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Contracted Capacity Charge ($/kW/month) | - | ||||||||

| Peak Period Charge (¢/kWh) | 6.46 | ||||||||

| Off-Peak Period Charge (¢/kWh) | 5.14 | ||||||||

| Reactive Power Charge (¢/kVArh) | - | ||||||||

| Uncontracted Capacity Charge 7 ($/kW/month) | - | ||||||||

| Uncontracted Capacity Charge 10 ($/kW/month) |

|

||||||||

| Low Tension - Small 6 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Contracted Capacity Charge ($/kW/month) | - | ||||||||

| Peak Period Charge (¢/kWh) | 6.46 | ||||||||

| Off-Peak Period Charge (¢/kWh) | 6.46 | ||||||||

| Reactive Power Charge (¢/kVArh) | - | ||||||||

| Uncontracted Capacity Charge 7 ($/kW/month) | - | ||||||||

| Uncontracted Capacity Charge 10 ($/kW/month) |

|

||||||||

- Ultra High Tension - for consumers taking supplies at 230kV, 50Hz, 3-phase, 3-wire for connection with minimum Contracted Capacity of 85,000kW*.

- Extra High Tension - for consumers taking supplies at 66kV, 50Hz, 3-phase, 3-wire for a Contracted Capacity:

- a. between 25,501kW and 84,999kW for service connection from the nearest feasible 66kV substation*

- b. between 85,000kW and 170,000kW for service connection from the nearest feasible 66kV source station*

- High Tension - Large - for consumers taking supplies at 22kV or 6.6kV, 50Hz, 3-phase, 3-wire for a Contracted Capacity:

- a. between 1,700kW and 12,750kW for 1 or 2 HT 22kV services*

- b. between 12,751kW and 25,500kW for 3 or 4 HT 22kV services*

- High Tension - Small - for consumers taking supplies at 22kV or 6.6kV, 50Hz, 3-phase, 3-wire for connection with Contracted Capacity of less than 1,700kW.

- Low Tension - Large - for contestable consumers taking supplies at 400V/230V.

- Low Tension - Small - for all non-contestable consumers taking supplies at 400V/230V. These are consumers who choose to buy electricity from SP Group at the regulated tariff.

-

The Uncontracted Capacity Charge (UCC) applies in the event that the maximum demand in kW (measured by the half-hour integration meter) exceeds the Contracted Capacity. UCC applies to:

- a. Normal customers without embedded generation;

- b. Customers with embedded generation who require top-up supplies and opt to summate their kW output from embedded generation and kW demand from the network (i.e Summation Scheme) for determining maximum demand; and

- c. Customers with embedded generation who require top-up supplies and opt to cap their power demand in kW drawn from the network (i.e Capped Capacity Scheme or Extended Capped Capacity Scheme). The UCC applies in the event that the maximum demand in kW (measured by the half-hour integration meter) exceeds the contracted capacity and shall be limited to 20% of the Contracted Capacity.

- For Capped Capacity Scheme (CCS), the Uncontracted Standby Capacity Charge (USCC), at 5 times of Contracted Capacity Charge, applies in the event that the demand in kW (measured by the power meter) drawn from the network exceeds 120% of the contracted capacity for a duration of more than 10 seconds continuously.

-

For Extended Capped Capacity Scheme (ECCS), the 2-tier Uncontracted Standby Capacity Charge (USCC) applies as follows:

- Tier 1: 5 times of Contracted Capacity Charge is applicable if the demand in kW drawn from the network exceeds 120% and up to 200% of the contracted capacity for a duration of more than 100 seconds continuously.

- Tier 2: 12 times of Contracted Capacity Charge is applicable if the demand in kW drawn from the network exceeds 200% of the contracted capacity for a duration of more than 10 seconds continuously.

- For both CCS and ECCS, the consumer shall at its own expense, install and maintain Load Limiting Device, in accordance with requirements that the Transmission Licensee may stipulate from time to time.

TECSS

Electricity Contracting Support for Large Business Consumers for month 2023 [CLOSED]

Update: Our Registration of Interest has closed. For other options, kindly visit EMA website. Thank you.

Introduction

- The Energy Market Authority (“EMA”) has received feedback that some large business consumers have experienced difficulties in securing fixed price electricity contracts in recent months due to unprecedented volatility in the global energy market as well as in the Singapore Wholesale Electricity Market.

- EMA has worked with Seraya Energy Pte Ltd to offer significant fixed price retail contracts to large business consumers who have difficulty in securing a retail contract for . While the fixed electricity price under the one-month retail contract reflects the prevailing high fuel prices, it will provide consumers with greater price certainty compared to the Wholesale Electricity Price (“WEP”).

- Large business consumers, with an Average Monthly Consumption of at least 4 MWh, are eligible to sign up for one-month fixed price retail contract for the month of .

- Towards the end of your contract, you can choose to re-contract with Seraya Energy Pte Ltd, switch to another retailer or switch back to buy electricity at the WEP.

- Following are the key terms of the Contract:

Electricity Retailer Seraya Energy Pte Ltd Type of Price Plan Fixed Price Plan# Contract Duration 2023 (or later) to 2023 Maximum Fixed Electricity Price (cents/kWh) cents/kWh Are the following third-party charges applicable and payable by the consumer in addition to the Fixed Electricity Price? Monthly Energy Uplift charges Yes Hourly Energy Uplift charges No Allocated Regulation Price Yes Energy Market Company fees Yes Power System Operator fees Yes Transmission Charges (Peak) Yes Transmission Charges (Offpeak) Yes Contracted Capacity Charges* Yes Uncontracted Capacity Charges* Yes Reactive Power Charges* Yes Meter Reading & Data Management Charges Yes Market Development & System Charges Yes Vesting Contract Debit/Credits No Additional Fees and Charges Security Deposits - 1 month of Estimated Monthly Bill Amount (inclusive of GST)

- Estimated Monthly Bill Amount is the Maximum Fixed Electricity Price multiplied by the declared monthly consumption.

- Security Deposit must be furnished no later than 3 business day before contract start date.

Early Termination Charges 50% x estimated monthly bill amount Late Payment Charge Interest on the amount outstanding at the rate of 7.25% per annum. Transmission Loss Factor Pass-Through Carbon Tax Charge $2.04/MWh Payment Terms 10 calendar days Other Terms and Conditions All other terms and conditions shall follow Seraya Energy’s general terms and conditions provided in our quotation to you upon receiving your email request. # For the nominated monthly consumption only

* Not applicable for consumers taking supply at low-tension (i.e. below 6.6 kV) level. - If you are interested to find out more about our Contract, please submit your request here.

- Please note that the deadline to sign up for our Contract is on 25 May 2022. We seek your understanding that there will be no deadline extension.

EMA’s Consumer Advisory

Please note that the fixed electricity price under the one-month retail contracts offered by the participating retailers for the Temporary Electricity Contracting Support scheme show the maximum fixed electricity price for the contract month. Consumers can engage participating retailers to negotiate pricing and non-pricing terms. Retailers usually request consumer to provide more information such as their historical electricity consumption profile to adjust the electricity price and other terms.

The participating retailers’ offers under the scheme are subject to availability and will be contracted on a first-come-first-served basis. It is not compulsory for consumers to sign-up for monthly fixed price contracts. Consumers can continue to engage retailers on alternative pricing arrangements that best suit your needs.

FREQUENTLY ASKED QUESTIONS

- Who are eligible for the retail contracts offered?

Large non-domestic consumers with an average electricity consumption of at least 4MWh per month, who have difficulty securing a retail contract for 2023 or who will be buying electricity from the Singapore Wholesale Electricity Market (“SWEM”) through SP Group or a retailer at the Wholesale Electricity Price (“WEP”) in June are eligible for these contracts. - Why is there only a one-month price plan for June 2023?

With monthly price plans, consumers can avoid being locked into long-term contracts, allowing them to consider other offers upon the expiry of the contracts. Consumers are encouraged to negotiate with the retailers on pricing and non-pricing terms, including longer contract duration. - When can I sign up for the one-month fixed price plan and when does it expires?

Consumer can request for a quotation from participating retailer from . Consumer must sign up before (“Deadline”). There will be no further extension of the Deadline. - When does the one-month fixed price contract starts and when does it expires?

The contract start date will be on or later and with the end-date no later than . Security Deposit has to be provided to the participating retailer before the contract can commenced. - What will happen when my contract expires by ?

If you have not entered into any retail contract with the participating retailer for , your account will be transferred back to SP Group on WEP when the contract expires on . - Is it compulsory for eligible consumers to sign up for these price plans?

It is not compulsory for eligible consumers to sign up for these price plans. They can continue to negotiate with retailers for alternatively arrangements that best suit their needs.

Form Downloads (Business)

Forms Download

If you require further assistance,

please contact your dedicated sales consultant.

Contact Us (Business)

Contact Us

Drop us a note and we’ll get right back

to you as soon as we can.

Contact details

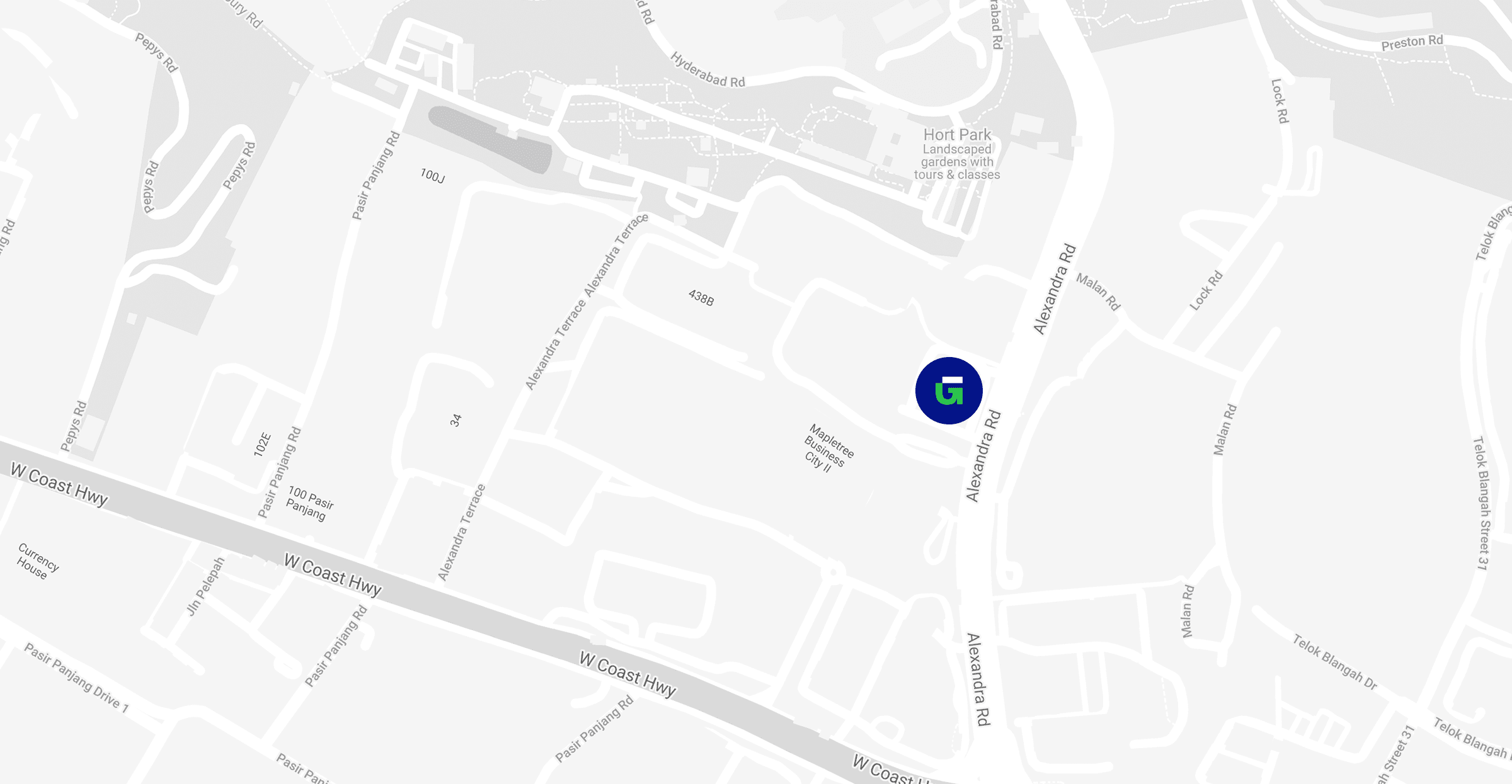

450 Alexandra Road

#01-01

Singapore 119960Phone: 6363 6688

TALK TO US INSTEAD

If you’re unsure about something, just drop us a line.

We’re happy to help you in any way.

FAQ (Business)

Frequently Asked Questions

Choosing Geneco

Contract Matters

Billing & Account

Electricity Glossary

Search result

Choosing Geneco

Why is the electricity retail market being deregulated?

The deregulation of the electricity market will encourage and promote competition within the various players in the electricity market and hence, provide competitively priced packages to consumers.

Since 2001, EMA has progressively opened the retail electricity market to competition to allow business consumers more options to manage their energy cost. Instead of buying from SP Group at the regulated tariff, eligible consumers can choose to buy from a retailer at a price plan that best meet their needs, or buy from the wholesale electricity market at the half-hourly wholesale electricity prices. Those who exercise this choice are termed as contestable consumers.

How do I know if my business is eligible to switch from SP Services to Geneco?

With the open electricity market, all businesses are eligible to apply for contestability and switch to a retailer of their choice regardless of consumption. The application process is free of charge.

Click here to view our electricity plans and we will assist with the application for contestability for a switch to Geneco.

What are the choices for contestable consumers?

If you are contestable, you can choose to purchase electricity from one of the following methods:

- From a Licensed Electricity Retailer (such as Geneco).

- From the Wholesale Spot Market as a direct market participant.

- From the Wholesale Spot Market through the Market Support Services Licensee (MSSL) (which is currently SP Group).

What are the advantages of buying from Geneco?

With over 49 years of power generation, Geneco is attuned to the changing needs of our customers and has been working hand in hand with businesses to provide them with a wide range of pricing options and energy solutions – enabling them to choose packages that best meet their needs.

Adopting a transparent approach, customers can be assured of excellent service quality coupled with a suite of services that centre around an efficient electricity supply to our customers.

To receive a competitive quotation from us, you may request for a quotation here. Our sales professionals will then contact you and work out a customized energy solution for your business.

Why is MSSL under SP Services Ltd involved in my account switching from SP Group to Geneco?

SP Services Ltd, a member of SP Group, is the Market Support Services Licensee (MSSL) providing Market Support Services such as reading of electricity meters, data management and facilitation the transfer of customers from electrical retailers.

Once Geneco has established the transfer, your meter reading data records will be provided to Geneco from SP Services Ltd/MSSL.

Power Eco Add-on

What are Carbon Credits (CCs)?

Carbon Credits (CCs) represent a reduction or removal of carbon dioxide equivalent of Greenhouse Gases (GHG) achieved by various projects around the world, which comply with and are registered under internationally recognised standards, such as the Verified Carbon Standard (VCS).

You may find out more here.

What are Renewable Energy Certificates (RECs)?

Renewable Energy Certificates (RECs) represent units of electricity generated from renewable energy generation facilities. These facilities comply with and are registered under internationally recognised standards, such as the I-REC standard, and are eligible to be issued RECs for every unit of electricity generated.

You may find out more here.

What is the difference between Carbon Credits (CCs) and Renewable Energy Certificates (RECs)?

Both CCs and RECs represent the positive impacts on the environment that can help mitigate GHG emissions. CCs represent the metric tonnes of emissions that have been avoided or reduced, while RECs represent attributes of the megawatt hours of renewable energy generation. You can read our blogs and find out more about the difference between Carbon Credits and Renewable Energy Certificates.

Where are the Carbon Credits (CCs) and Renewable Energy Certificates (RECs) from?

Geneco works with a network of partners to source for CCs and RECs from projects in India, China, and Southeast Asia.

I would like to reduce my business’s carbon footprint, how should I go about signing up for Power Eco Add-on?

Kick-start your business’s eco-journey in 3 simple steps:

Step 1: Choose an electricity plan (12/ 24/ 36 months)

Step 2: Select Carbon Credits (CCs) OR Renewable Energy Certificates (RECs)

Step 3: Choose your level of green contribution (25%/ 50%/ 75%/ 100%)

I have an existing active Electricity Retail Contract with Geneco, can I still sign up for Power Eco Add-on?

If you are not on any Power Eco Add-on for your existing Biz Fixed 12/ Biz Fixed 24 / Biz Fixed 36 active contract, you may opt for either CCs or RECs and choose your level of green contribution (25/50/75/100%).

If you are already on Power Eco Add-on for your existing active contract, you may choose to upgrade your level of green contribution.

You may opt for Power Eco Add-on or upgrade via the Power Eco Add-on tab in the Self-Service Portal.

Why am I not eligible to opt-in/ upgrade for Power Eco Add-on under my existing active Electricity Retail Contract?

This might be due to one of the following reasons:

- Your electricity plan already includes Power Eco 100% Add-on

- Your existing active Electricity Retail Contract is up for renewal

- You are under the 30 calendar days grace period for autorenewal

- You have requested to close/transfer out your account from Geneco

- Your Electricity Retail Contract has yet to start

- You are not on the eligible price plan (Biz Fixed) to opt-in for Power Eco Add-on

How do I receive my Carbon Offset Certificate or Renewable Energy Certificate?

At the end of the last billing cycle of each calendar year or contract end/termination, Geneco will determine how many CCs/RECs you will be receiving based on your electricity consumption and the percentage of CCs/RECs that you have chosen. Geneco will retire the CCs/RECs on your behalf and you will receive the soft copy of the Carbon Offset Certificate or Renewable Energy Certificate via email no later than the end of March of the following year.

The last billing cycle of each calendar year is defined as the billing cycle that consists of the last day of the calendar year, and the last billing cycle of each contract end/ termination is defined as the billing cycle that consists of the contract end date/termination date.

The Certificate will show how many CCs/RECs was retired on your behalf for that calendar year.

Why is CC Add-on a non-taxable charge while REC Add-on is a taxable charge?

The Inland Revenue Authority of Singapore (IRAS) announced in November 2022 on its website that the issuance, transfer, or sale of Carbon Credits—or the digital representation of such credits—will no longer be treated as a supply of goods or services for Goods and Services Tax (GST) purposes as of 23 November 2022.

Whereas, no statement has been made regarding the treatment of Renewable Energy Certificates, and it will continue to be treated as a supply of goods or services for the purpose of Goods and Services Tax (GST).

How is the amount of Greenhouse Gas (GHG) emission determined from my business’s consumption of electricity?

The GHG emission associated with your electricity consumption is determined from multiplying the Electricity Grid Emission Factor (GEF) by the amount of electricity you used. The latest GEF published by the Energy Market Authority is 0.4168(kg CO2 / kWh) in 2022.

| Year | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Grid Emission Factor | 0.4206 | 0.4085 | 0.4074 | 0.4085 | 0.4168 |

| Year | Grid Emission Factor |

|---|---|

| 2018 | 0.4206 |

| 2019 | 0.4085 |

| 2020 | 0.4074 |

| 2021 | 0.4085 |

| 2022 | 0.4168 |

*The historical 2021 GEF has been revised by EMA.

To learn more about the Electricity Grid Emission Factor, you can find out more here.

Do I need to install a solar PV system at my business’s premises if I choose the Power Eco Add-on (RECs)?

No, the installation of a solar PV system is not required for Power Eco Add-on (RECs). However, if you have unutilised roof space at your business’s premises and are keen to install solar panels to further reduce carbon emission, you can visit our website and submit your interest for a site visit.

Will the Power Eco Add-on affect my business’s electricity supply?

No, your business’s electricity will continue to be supplied from the electricity grid.

Can I change the percentage of CCs or RECs that I get from my Power Eco Add-on or cancel it during my contract?

Once your contract has been activated, you will be able to upgrade your Power Eco Add-on percentage at any time. However, you will not be able to downgrade or cancel it during your contract period.

How are my meter readings recorded after switching to Geneco?

Readings will be done via Advanced meters, also known as smart meters or Advanced Metering Infrastructure (AMI) meters which allow electricity consumption to be measured at half-hourly intervals.

How do I know if I am charged correctly for my utilities usage?

Meter data is downloaded by MSSL (SP Group). This ensures the highest level of accuracy in your electricity charges.

What should I do if I suspect that my electricity meter is faulty?

You can request for a meter test through SP PowerGrid (SP Group) at 1800 778 8888.

An administrative fee of $80 will be imposed (by SP Group) for each test and this is fully refundable if the meter is found to be faulty.

Are there additional charges for installing a new meter?

For non-contestable Business consumers who would like to gain contestability, you will need to install a new Advanced Metering Infrastructure (AMI) electricity meter. The installation charge by SP PowerGrid will be at $40/meter (excl GST).

Can I switch back to SP Group?

You can switch back to buy electricity from SP Group at the regulated tariff. Businesses with an average monthly consumption of less than 4,000 kWh (monthly electricity bill of $800 or lower) can switch back to buying electricity from SP Group at the regulated tariff.

You may check the eligibility to switch back to buy electricity at regulated tariff here.

Will there be any early termination fees if I did not fulfil my contract?

Yes, early termination fees will be imposed where applicable if the consumer did not fulfil the full term contract.

My contract is expiring. What should I do?

Contact us at contact@geneco.sg or reply to the email that you will receive before your contract expiry. Alternatively, you can choose to review your existing plan by filling up the form here.

What is the procedure for an account closure if I am moving out of my existing premises?

Please submit the account closure form 30 days in advance and we will contact you on the procedure of closure. Alternatively, please contact us at contact@geneco.sg or here.

How will the change in GST rate affect my monthly bill?

From 1 January 2024 onwards, the revised GST rate of 9% will be applied on all chargeable items which include, but not limited to:

- Published Prices related to Electricity Rates

- Administrative Charges (such as Account Closure Fee, and more)

Invoices dated on or after 1 January 2024 may contain both an 8% GST charge for your electricity usage before 1 January 2024 and a 9% GST charge for your electricity usage from 1 January 2024 onwards.

How do I pay for my Geneco invoices?

You may choose the payment methods below:

- One-time payment

- PayNow via QR code. Please refer to your monthly invoice for the unique QR code.

- Telegraphic Transfer (TT) / Funds Transfer. You may also transfer the funds to our bank account directly.

- AXS Station, AXS e-Station or AXS m-Station by selecting Geneco on the payment platform. Kindly note that AXS transaction has a payment limit for each transaction.

- Recurring payment

- GIRO. Please download and complete this GIRO form. Original copy to be mailed to us at:

Seraya Energy Pte Ltd

450 Alexandra Road #01-01

Singapore 119960

Why is Geneco encouraging e-Bill instead of sending paper bills statement?

Geneco strives towards paperless billing for our environment. In line with our commitment towards environmental sustainability, we are going digital and would like to encourage all customers to go paperless. You will be notified of your monthly bill and payment due date via email. You can also login to customer portal to get an overview of your bills and outstanding balance.

If you have not received your log-in details, please contact us at contact@geneco.sg or here.

How do I request for past bills?

You can check the past bills (up to 12 months) via our Geneco Self-Service Portal here. If you require billing history prior to 12 months, please write to us here. Kindly note that there will be a charge of $5.45 (Inclusive of GST) per bill requested.

Who can I contact for assistance on my Geneco account?

If you have any queries regarding your account or wish to make any changes/updates to your account, please contact us at contact@geneco.sg or here.

What is Carbon Tax and how does it impact my Geneco bills?

During the Singapore Budget 2018, it was announced that a carbon tax of S$5 per tonne of carbon emissions will be introduced from 2019 to 2023. In line with these measures, a carbon charge will apply to all commercial customers for every unit of electricity consumed from 1 January 2019 onwards. This initiative aims to encourage both emitters and downstream consumers to be more energy efficient. Click here for more information about carbon tax.

How is Transmission Loss Factor (TLF) calculated?

The Transmission Loss Factor (TLF) is calculated by the Market Support Services Licensee, SP Services Ltd in accordance with the methodology approved by the regulator, the Energy Market Authority of Singapore. To learn more, visit our page here.

What is Use of System Charge (UOS)?

The Use-of-System charges, which is payable to SP Group, is to recover the cost of transporting electricity through the national power grid. Please note that the charges differ according to the voltage at which a consumer receives the electricity supply. To learn more, visit our page here.

Common Energy Terms

AFP Charge

This is the charge for the recovery of the cost incurred for the procurement of Regulation. Regulation is energy needed to fine-tune between the generation and consumption of electricity on a half-hourly basis.

Contestability

The right to choose among electricity retailers for electricity purchase.

Contestable Consumer

Consumer who has the right to choose how and whom they want to buy electricity from.

EMC Admin Charge

EMC (Energy Market Company) operates the wholesale electricity market. EMC runs the electricity pool and manages the energy settlement processes. This is a usage-based charge calculated using loss adjusted data.

Energy Audit

A programme whereby an energy auditor or energy auditing company inspects a facility or premise to assess the energy use and suggest ways of saving energy.

Energy Market Authority (EMA)

The regulator of the electricity and gas industry in Singapore.

Energy Market Company (EMC)

The company that operates and administers the wholesale electricity market.

Generation Company (Genco)

A company that produces electricity.

Grid

A system of interconnected power lines that transport electricity from generators to consumers.

HEUC

This charge captures any differences between total amounts received from retailers and total amounts paid to generators for energy, reserve and regulation products. While the HEUC is called a charge, it is typically a return to retailers of the revenue arising from the sale of energy to cover transmission losses.

Load

The amount of electrical power required by a consumer.

Market Power

The ability of a seller/buyer, either individually or in collaboration with other sellers/buyers, to influence the price of electricity in the market.

Market Support Services (MSS)

These are services such as the buying of electricity indirectly from the wholesale electricity market for contestable consumers at spot prices, reading meters, managing meter data, administering transfer processes, and providing electricity to non-contestable consumers at regulated tariffs.

Market Support Services (MSS) Charges

Charges to cover the costs of market support services, such as transfer processing fees, meter reading fees, etc.

Market Support Services Licensee (MSSL)

The company that is licensed to provide market support services SP Services Ltd is the MSSL.

MEUC

This is a usage-based charge computed using loss-adjusted data. This charge is for the recovery of the cost incurred by the System Operator to procure supplementary services from the market to ensure the security and reliability of the electricity system. For example, Black Start Service is procured to re-start the system during a total blackout.

Non-Contestable Consumers

Consumers who are required to buy electricity from the MSSL at regulated tariffs.

Off-Peak Period and Peak Period

Period of time when there is relatively low demand for electricity. Period of time when there is relatively high demand for electricity.

PSO Admin Charge

PSO (Power System Operator) is responsible for the security and reliability of the transmission system. All customers pay a usage-based fee for the provision of this service.

Regulated Tariffs

Electricity prices for non-contestable consumers. Regulated tariffs are approved by the regulator.

Regulator

The statutory body that regulates the electricity industry in Singapore. The Energy Market Authority is the regulator.

Spot Prices

Prices determined half hourly on the wholesale market depending on demand and supply. Spot prices are not regulated or set by the regulator.

Terms of Contract/Contract Terms

The terms set out in the contract between an electricity retailer and a contestable consumer for the purchase of electricity, such as the contract duration, payment terms, mode of payment and contract termination provision etc.

Transmission

The process of delivering electricity from generation plants to consumers’ premises over the transmission system.

Transmission Charges

The charges for the use of the transmission system to deliver electricity to consumers’ premises. Transmission charges are regulated by the regulator.

Transmission Licensee

The company that is licensed to own the electricity transmission system and deliver electricity from generation plants to consumers’ premises. SP PowerAssets Ltd (SPPA) is the Transmission Licensee. SP PowerGrid Ltd (SPPG) is the agent appointed by SPPA to maintain and operate the electricity transmission system.

USEP

Price paid by consumers for electricity generated and supplied for consumption.

Vesting Contracts

Bilateral contracts between generation companies and MSSL for the production and sale of a specified quantity of electricity at a specified price (known as the “vesting price”). Vesting contracts are imposed by the regulator to curb market power of generation companies.

Vesting Debit/Credit

Reflected in MSSL’s bill to contestable consumers buying electricity from the wholesale market through MSSL. It is the difference between spot prices and vesting price on the demand that is covered by vesting contract.

Wholesale Electricity Market

An electricity market where generation companies compete to sell electricity.

Wholesale Electricity Price (WEP)

When buying electricity directly or indirectly from the National Electricity Market of Singapore (NEMS), one’s electricity price comprises of 6 components with USEP being by far the largest of the 6 components. The other components are the Hourly Energy Uplift Charge (HEUC), the Monthly Energy Uplift Charge (MEUC), the Allocated Regulation Price (AFP), PSO admin fees and EMC admin fees.